Confidence improves across North America and Europe, though growth expectations suggest a measured – not exuberant – year for the channel.

By Larry Walsh

A new year brings new beginnings and possibilities. That sentiment is reflected in the first-quarter results of the Channelnomics Partner Confidence Index (PCI). After seeing confidence sag over much of 2025 amid the economic uncertainty wrought by the Trump administration’s chaotic tariffs and trade policies, North American and European solution providers’ confidence rebounded at the start of the new year.

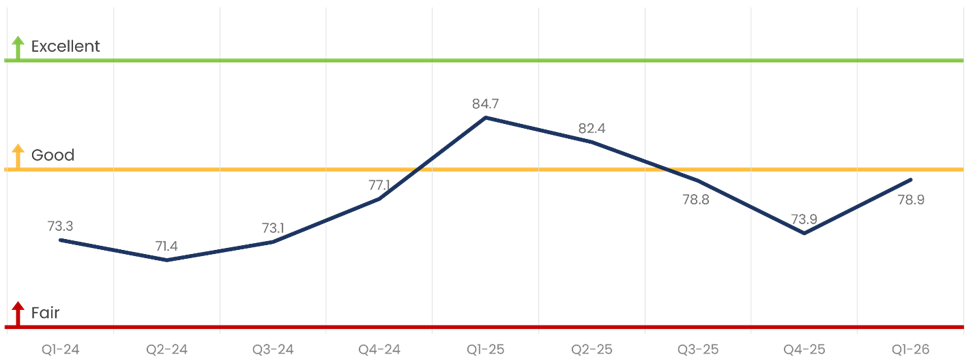

Confidence among North American partners jumped five points to 78.9, but it remains in what Channelnomics rates as the “fair” zone. The rebound follows a peak of nearly 85 points on our scale in the first quarter of 2025, after which confidence declined each quarter through the end of the year.

North America Partner Confidence Rating for Q1 2026

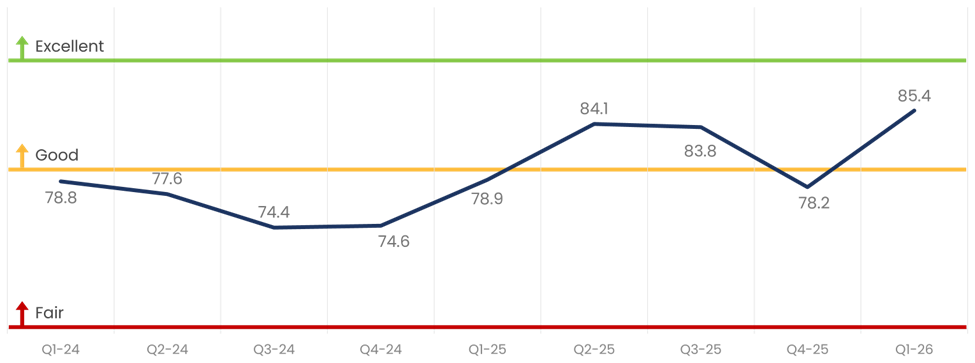

In Europe, partner confidence didn’t suffer as much. Confidence peaked in the second quarter of 2025 at 84 points — a “good” rating on our scale — and remained steady through the third quarter before dipping almost six points toward the end of the year.

European Partner Confidence Rating for Q1 2026

On both sides of the Atlantic, solution providers are generally optimistic about their ability to increase revenue and profits. As a result, they’re increasing investments to transform and evolve their businesses, hire new staff, and maintain their competitive positions in the market.

There are two drivers behind this renewed confidence. First, Western economies didn’t break under the pressure of the 2025 trade war. Second, demand for emerging technologies — particularly artificial intelligence and security — is lifting spending. Solution providers in both North America and Europe expect their revenue and profits to increase by 10% to 14%, on average, which is in line with projections that IT spending will expand by 10%this year.

This isn’t to say that solution providers are without challenges. Many continue to grapple with economic pressures, the pace of change and rising customer expectations, and the need to meet vendor requirements. However, they remain confident in their ability to adapt and generally positive about their prospects.

While the typically buoyed confidence among partners and vendors in the first quarter of a new year isn’t always in line with outcomes, Channelnomics believes 2026 will meet overall market and channel performance expectations. The 10% projection likely won’t fully translate to the channel. Growth there will more likely fall between 5% and 7%, but under any circumstances, that level of growth is more than solid.

The full Q1 2026 PCI reports for North America and Europe are available to Channelnomics IQ members. Those interested in obtaining the reports may e-mail us at info@channelnomics.com.

*********************************************************************************

Larry Walsh is the CEO, chief analyst, and founder of Channelnomics. He’s an expert on the development and execution of channel programs, disruptive sales models, and growth strategies for companies worldwide.